Doximity (DOCS)·Q3 2026 Earnings Summary

Doximity Beats Q3 but Stock Crashes 40% as Pharma Budgets Stall

February 5, 2026 · by Fintool AI Agent

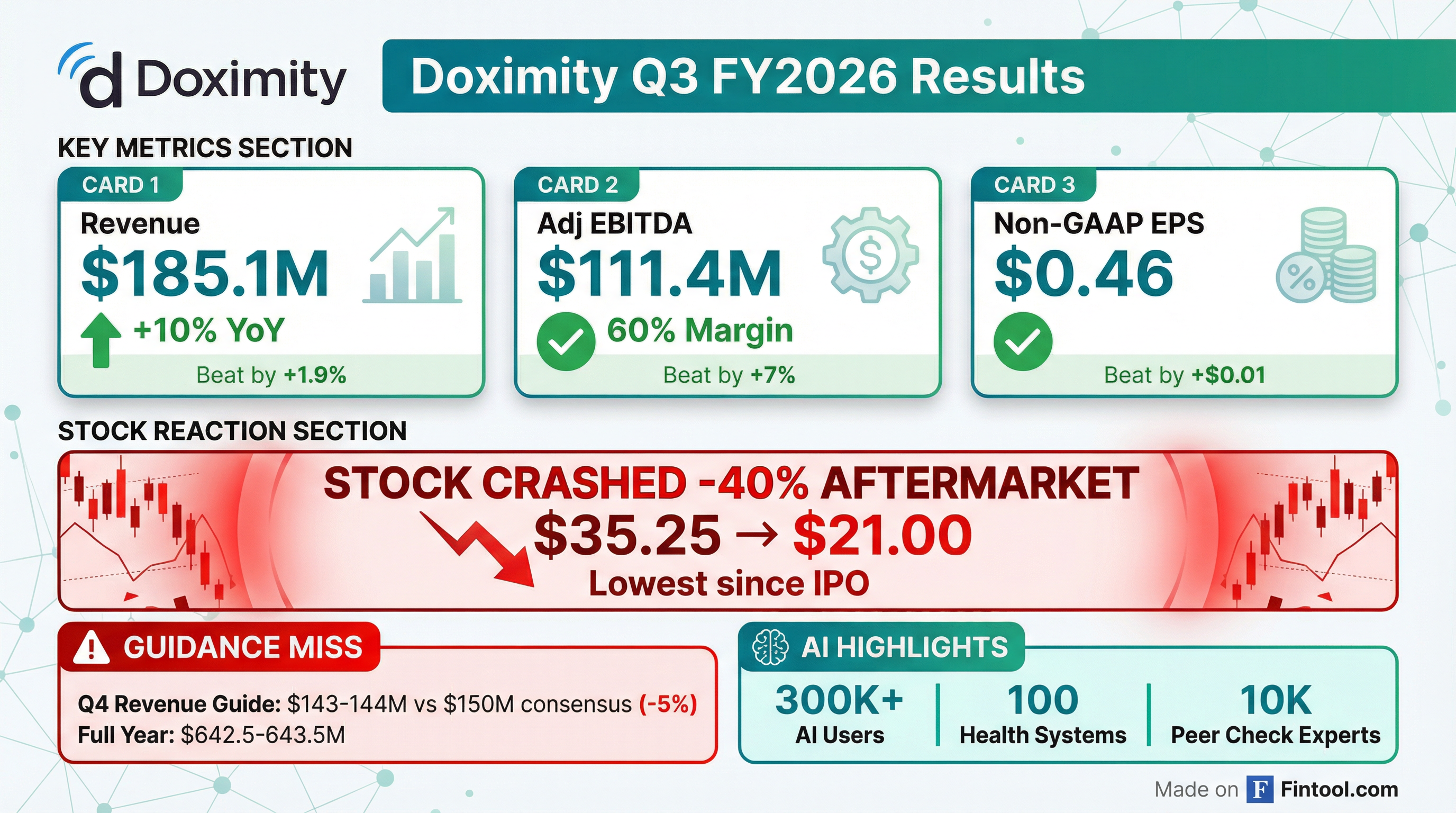

Doximity (NYSE: DOCS) delivered a clean beat on Q3 FY2026, but shares crashed 40% in aftermarket trading to $21.00 after management issued Q4 revenue guidance roughly 5% below consensus. The culprit: pharma budget paralysis from Most Favored Nation (MFN) uncertainty, with 16 of the top 20 pharmaceutical companies signing MFN deals with the White House between late December and early January—right in the middle of Doximity's annual selling season.

Did Doximity Beat Earnings?

Yes. Doximity beat on all key metrics for Q3:

*Values retrieved from S&P Global

Revenue grew 10% YoY and exceeded the high end of guidance by 2%. Adjusted EBITDA of $111.4M was 7% above the high end of guidance. Net revenue retention was 112%, with top 20 customers at 117%.

How Did the Stock React?

Doximity shares collapsed 40% in aftermarket trading—one of the largest post-earnings selloffs in the company's history:

The aftermarket crash brings DOCS to its lowest level since going public in 2021. The selloff reflects the market's concern that pharma advertising headwinds may persist beyond a single quarter.

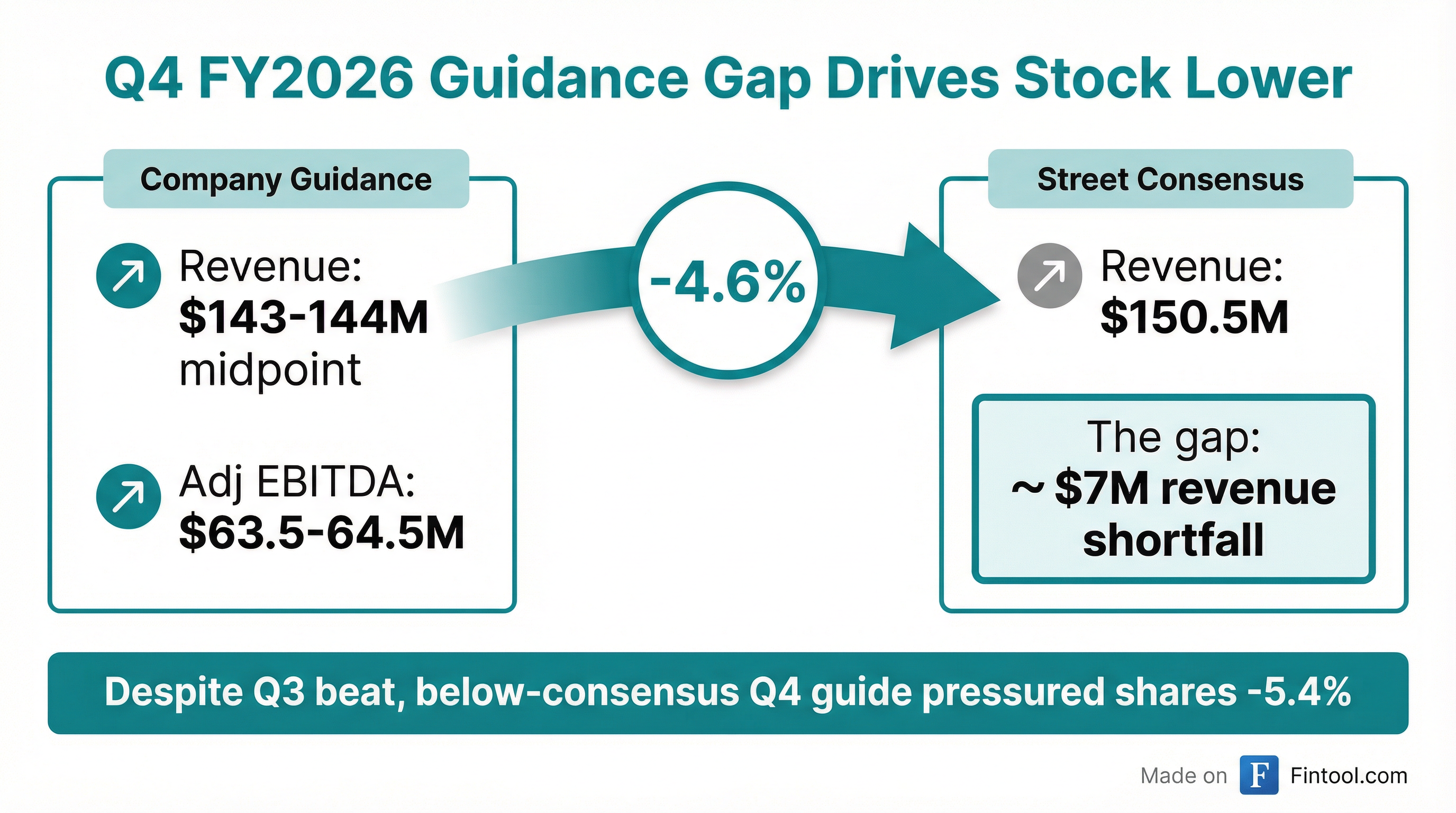

What Did Management Guide?

Q4 guidance came in materially below Street expectations:

The Q4 guidance implies just 4% YoY revenue growth, a sharp deceleration from 10% in Q3 and 23% in Q2.

What Caused the Weak Guidance?

Management was explicit: MFN (Most Favored Nation) deals signed by major pharma companies with the White House created unprecedented uncertainty during the annual selling season.

Key dynamics:

- 16 of 20 top pharma companies signed MFN deals between late December and early January, right when annual contracts are typically finalized

- Budget freeze: Many brand managers wanted to deploy funds with Doximity but "hadn't got approval of those funds released yet" from top-down

- Deal slippage: Multiple deals that normally close by December 31 were pushed into fiscal Q4

- Lower upfront deployment: Customers deployed a lower percentage of annual budgets upfront than usual

"You have many of these top 20 pharma companies that still haven't signed off on these big deals with the White House, these MFN deals, which are pretty broad-based, to do with pricing and tariffs. So it's a large bogey, a lot of uncertainty at the very end of the year." — Perry Gold, VP Investor Relations

The silver lining: January pharma bookings showed the best growth rate since Doximity went public, confirming delayed decision-making rather than lost demand.

What Changed From Last Quarter?

CFO Transition: CFO Anna Bryson is on medical leave. Tim Cabral, former 10-year CFO of Veeva Systems and current Doximity audit committee chair, is stepping in to guide the finance team.

New Buyback Authorization: The board approved a new $500 million open-ended share repurchase authorization with no expiration date. This follows $196.8M in Q3 repurchases.

AI Progress: The Bull Case

The AI narrative is accelerating rapidly:

CEO Jeff Tangney highlighted Doximity's unique AI moat:

"These aren't just any doctors doing our Peer Check, but rather the actual experts and authors cited by the AI for each question. For 15 years now, we've painstakingly mapped each doctor to each paper and trial, so we know the right expert right away."

"We're the only medical AI to provide full PDF access to over 2,000 medical journals. Our drug reference is built-in deterministic, not probabilistic—LLMs struggle with drug dosages, and that's where you really don't want to get it wrong."

Commercial AI products are expected later this year, which should tap into innovation, upsell, and search budgets. Management sees a large TAM opportunity: 55% of digital marketing spend in healthcare is for search.

Engagement KPIs at Record Levels

For the fifth year in a row, Doximity Dialer was ranked the #1 best-in-class telehealth platform by health system CIOs.

Customer Concentration and Retention

"Our biggest, most sophisticated customers once again represented our fastest-growing." — Tim Cabral

Balance Sheet Snapshot

Calendar 2026 Outlook

Management struck an optimistic tone for the back half of calendar 2026:

-

Double-digit exit growth: "We actually feel really good about our ability to exit the calendar year as a double-digit grower once again."

-

Budget release: Unreleased funds should become available as pharma companies complete 2026 planning.

-

MFN clarity: With 16 of 20 top pharma manufacturers now signed, companies should be able to more confidently execute media plans.

-

AI commercial launch: Products expected in market later this year, tapping innovation and search budgets.

Operating assumption: Market will grow ~5% in calendar 2026 (per eMarketer). Doximity expects to outgrow the market as it has every year since going public.

Q&A Highlights

On competitive dynamics in AI:

"We've grown to over 300,000 quarterly active doctors, which is just a terrific pace. I don't think any other company could do that. The 100 hospitals are major health systems representing 20% of all US doctors." — Jeff Tangney, CEO

On pharma budget dynamics:

"This isn't the first time we've seen something like this. Two years ago, Q4 was mid-single-digit revenue growth... When you went to the first quarter, there was a nice step up in revenue growth as those things normalized. This is an anomaly, not a new norm." — Perry Gold

On AI trust and physician adoption:

"The only problem from the doctor's point of view when you look at AI today is you really can't trust it. They're putting their license on the line with every patient. These are life or death decisions. So there's still this need to check multiple sources. AI is fast, but they want textbook trusted and AI fast." — Jeff Tangney

On talent competition:

"The talent wars definitely are heating up. We are retaining our best people, offering them stock grants. It's an advantage in this market to be a company with such a long-held purpose and deep roots in the medical industry." — Jeff Tangney

Forward Estimates

*Values retrieved from S&P Global. Note: Estimates may be revised following today's guidance miss.

What To Watch Going Forward

-

April Upsell Season: Will delayed pharma budgets materialize in the mid-year selling window? Management is optimistic.

-

AI Commercialization: First commercial AI products expected later this year. Search TAM is massive (55% of healthcare digital marketing).

-

Stock Stabilization: At $21, DOCS trades at ~5x FY2026 revenue and ~15x EBITDA—historically cheap for a 60% EBITDA margin business.

-

CFO Return: Monitor Anna Bryson's medical leave and any changes to financial leadership.

-

MFN Fallout: Watch whether MFN uncertainty persists into calendar 2027 upfront season.

Related Links: